There are many wonderful payroll processing apps similar to OnPay, Gusto, ADP, Paychex, and so on. out there out there. Let me help you invite your workers to make use of QuickBooks Workforce in multiple steps relying on the program you are utilizing. To see the status of your employee’s setup, select Payroll, then Employees. If your worker has access to your QuickBooks Online (QBO) account, ensure they use a unique e mail for Workforce than the one they use to check in to QBO. I Am joining the dialog to assist together with your query about utilizing payroll on your mobile gadget, sparkling.

You can choose whether you need your workers to have access to the workforce portal or not whereas including their names to the payroll database. If you are a QuickBooks Payroll Elite consumer, you are eligible for tax penalty protection. If you receive a tax notice and ship it to QuickBooks inside 15 days of the tax discover, QuickBooks covers as a lot as $25,000 of the payroll tax penalty. QuickBooks Payroll provides skilled evaluate with its top-tier plan. Lately, it has added stay support to its QuickBooks On-line plans.

You can also embody a screenshot in your next reply, just be certain to cowl all important details. At Business.org, our research is meant to supply common product and service recommendations. We don’t guarantee that our recommendations will work greatest for each individual or enterprise, so consider your distinctive wants when selecting products and services. Staff can submit their own pay preferences, personal details, and tax info, so you can add them to your payroll with out the effort https://www.quickbooks-payroll.org/.

If you are including them manually, you can begin simply with the name and e mail address. The other particulars required for working payroll, similar to date of joining, hourly rates, paid time off, etc., could be added later. QuickBooks Payroll mechanically calculates payroll so that you don’t want to worry about the means to calculate payroll each month.

Cut Back Tasks With Team Hub

- SurePayroll is an affordable and easy payroll software program that gives computerized payroll runs, tax submitting, and distinctive customer service.

- QuickBooks Payroll addresses widespread issues similar to calculating payroll taxes, filing tax forms, and maintaining with new payroll requirements.

- In contrast to most small-business payroll solutions, QuickBooks Payroll has a stand-out cell app for employers.

- The two merchandise integrate easily with each other, which means it’s straightforward to add a QuickBooks payroll plan to your QuickBooks accounting subscription and vice versa.

On the opposite hand, if you love QuickBooks Online however aren’t thrilled about QuickBooks Payroll, you may have dozens of options. Competitors like Gusto, Paychex, OnPay—honestly, most payroll software solutions—all sync simply with QuickBooks Online. Workers can edit their name, handle, and tax withholding. Staff will not have the power to edit their checking account data, social security number, or change their handle to a state that isn’t already arrange in your payroll account.

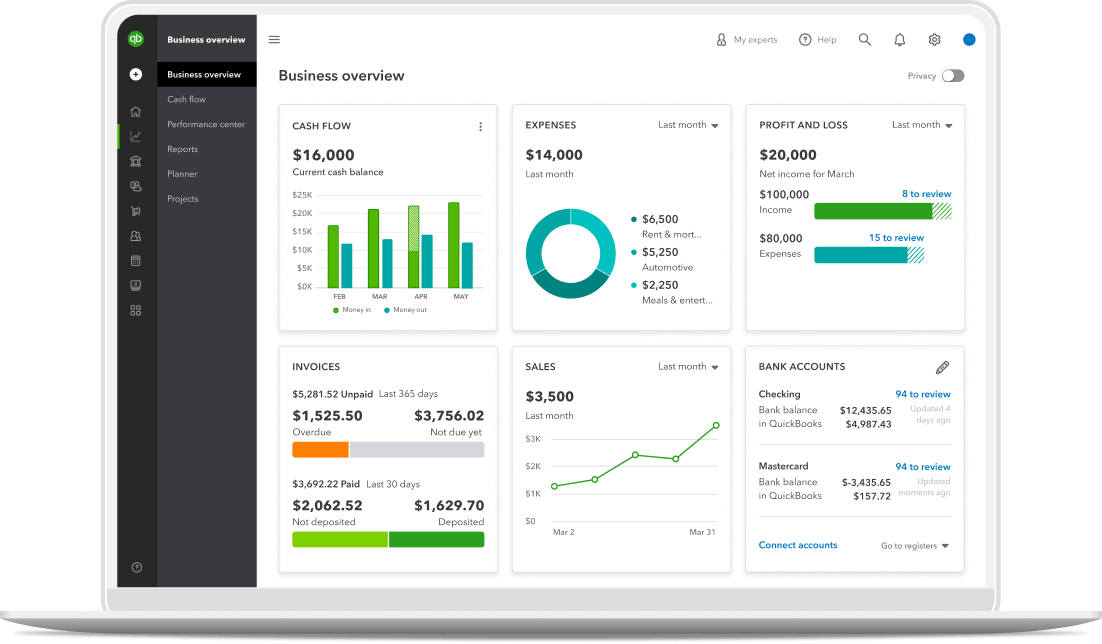

But when you do this, you can’t see the total hours worked. Sure, each QuickBooks Payroll plan includes automatic payroll tax calculation, deductions, and filing. In Distinction To some opponents, like ADP, QuickBooks Payroll additionally automatically information end-of-year tax types like W-2s at no additional cost. Your payroll numbers will automatically sync along with your QuickBooks On-line account, which makes e-filing payroll taxes about as straightforward as possible. QuickBooks Payroll is easier to use than different payroll purposes. The intuitive and straightforward consumer interface makes it accessible for first-time customers.

Is Quickbooks Payroll Right For Me?

Plus, if you’re already conversant in QuickBooks On-line, QuickBooks Payroll’s related interface and seamless integration can simplify your payroll and accounting processes. Although Intuit (QuickBooks’ mother or father company) has a A- score with the Better Enterprise Bureau (BBB), customers have logged greater than 3,one hundred complaints. Most customers complain of slow, unhelpful cellphone support—a big frustration when a software program downside keeps you from paying workers on time.

If you don’t go for a 30-day free trial, you can access one-time reside setup assist throughout the first 30 days. A QuickBooks expert guides you thru the whole setup together with connecting bank accounts and credit cards, establishing automations and learning finest practices. And 24/7 chat is available should you get stuck in any step later. QuickBooks Payroll has an intuitive and easy-to-use interface.

Product Particulars

But in case you are not already in the QuickBooks ecosystem, you’ll be able to contemplate different finest payroll apps obtainable available within the market before making a ultimate selection. If you have budget constraints, you can also take a glance at the free payroll apps obtainable quickbooks payroll app. You can take advantage of QuickBooks offers, the place you’ll find a way to either get a 30-day free trial or a 50% low cost on base fees for 3 months of service. For other plans, you should combine payroll with Facebook’s Time Meter or any other time monitoring app.

All you need to do is enter the details of all of your workers, arrange cost guidelines and repair the day their payroll must run. All QuickBooks Online Payroll plans supply full-service payroll. That means, in addition to automated payroll, you’ll receive full-service options. If QuickBooks Payroll isn’t a great match for you, check out our page evaluating payroll software program to discover a payroll plan that’s.

QuickBooks Payroll is on the market in all 50 states, however the Core and Premium services include free tax filing for one state only. QuickBooks Payroll Elite plan services embrace free multi-tax state and federal tax submitting. Your employee will obtain an email with a hyperlink to arrange and use QuickBooks Workforce. As Soon As arrange, they’ll add their info, (if you selected this option) choose out of a mailed copy of their W-2, and then view their pay stubs and W-2s.